Some states/municipalities have instituted a sales tax on advertising. If your stations are unfortunate enough to be subject to such regulation, take the following steps to activate this feature in SCOOTER, otherwise this section can be ignored.

Enabling the Sales Tax

In the Program Options section of Program Settings, place a check mark in the box marked Enable sales tax for selected stations. If this box is not checked, all the features associated with applying sales tax in SCOOTER are disabled. As this is a local setting, if in network mode each individual user must enable this option in his copy of the program.

When the sales tax option is enabled the status bar at the bottom Schedule Information window will have an additional section marked "Tax". As schedules subject to tax are entered, the amount of the resulting tax to be charged is displayed in this additional area.

Specifying Tax Rates

The tax rate for each station is entered individually. This allows different stations to have a different tax rate depending on the city of license, or some stations to apply tax while others do not. See the topic Stations under Program Settings for details.

SCOOTER uses "banker's rounding" to determine the sales tax applied to a schedule. If the fractional digit being rounded off is exactly five, with no trailing digits, the number is rounded to the nearest even number. This provides better results, on average, than the simple "round up at five" approach.

For those tax exempt organizations that advertise with you, checking the box Tax Exempt on the Billing Information tab of the Schedule Information window will eliminate all tax charges for that client. This setting applies universally for all schedules for a client so designated. In the event a client has some schedules that are tax exempt while others are not, it will be necessary to create two separate client records for that entity. One will have the Tax Exempt box checked; the other will not.

If a client is subject to tax for some ads while being tax exempt for others, this mix cannot be accommodated on a single schedule. It will be necessary to create two separate schedules, one for the taxable ads, and a second schedule for the tax free ads.

When a schedule is saved, all of the information associated with that schedule is normally saved, including the individual stations that were available when the schedule was created. If one of these stations is later removed from the station list due to a sale or other change, the deleted station remains as part of the original schedule but will not appear when new schedules for a client are created.

Because sales tax amounts are subject to change, tax rates are not archived as part of a schedule. Each time a schedule is opened, the current tax rates are obtained so all existing schedules are automatically updated should tax rates change. However, if a station has been deleted from the station list in Program Settings, there will be no tax rate available for schedules that include that deleted station. For this reason, it is strongly recommended to not delete a station from the station list if you are utilizing the sales tax option, even if that station is no longer operated by your organization. Once all old schedules featuring that station have been removed from the database, the station can then be deleted from the station list with no adverse consequences. Stations without schedules assigned appear highlighted in pink in Program Settings.

Tax Notation on Printed Schedules

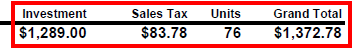

For clients subject to sales tax, the generated schedules and/or broadcast calendars will include an "Investment" amount, a "Sales Tax" amount, and a "Grand Total" which includes both the schedule cost and sales tax combined.

Sales Tax Totals Example